I have just seen the recent summary report of the CRM market from Gartner.

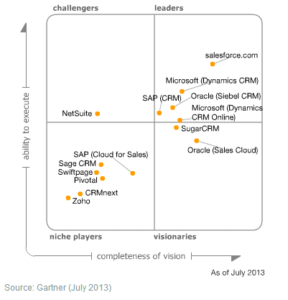

For those not aware of Gartner, they are one of a number of companies who carry out independent reviews of technology and markets. They offer reports on technology markets growth results and expectations. They also provide reviews and opinions of which technologies\products\vendors are leaders in a particular field, displaying the findings in the “Magic Quadrant”.

Larger vendors invest quite some time courting such analyst firms, keen to get their latest version in front of the analysts so that the next report on the software and trends will show their product in the best light. There is a belief that these reports are critical in the success of their product and failure to have your product in the top right corner of the Magic Quadrant is a bad thing. i.e. prospective customers will avidly read such reports and automatically pick the product with the highest rating in the Magic Quadrant.

I have not always been convinced of the value and relevance of these reports. I would only accept in general terms the comparative of how good one product was verses another. My reason being is that for a specific customer requirement, one product may compare very positively against another, yet in another situation, the selection might be reversed.

With any review on any item, 5 stars do not necessarily make that item the one for you. It may increase your confidence to look closer but you need to read between the lines of the review to see why that reviewer has given it 5 stars. Do their reasons marry up with your own requirements or views?

How relevant are they?

My other consideration is how relevant are these reports to the SMB sector? It is important for anyone looking at the reviews too consider from what perspective are they be reviewed. And this is where I have cause for concern with the latest report on the CRM market from Gartner. My perspective is looking at CRM from the point of view of the market QGate supports, i.e. the SMB sector. In terms of numbers of companies, the largest business sector, and therefore the largest number of CRM selection decisions to be made. But not the largest per sale revenue line for the vendors though, Enterprise companies will bring more revenue to vendors.

If you look at the report, there are a couple of glaring things that stand out to me that reduce the value of the report and at least detract from the validity of the report certainly as far as most SMBs are concerned.

1) The report shows that 50% of the CRM revenue in 2013 was from “other” CRM vendors. i.e. $10.2Bn was generated by vendors Gartner didn’t name.

So one has to assume this includes the likes of SugarCRM, Act!, Saleslogix, Sage CRM and the numerous others. But surely not breaking down this very sizable chunk of the revenue spend is not very helpful or insightful.

2) IBM (indicated as a vendor) accounted for 3.9% of the revenue.

IBM CRM??? What is that? Never heard of it. Well if you browse the IBM site(s) you see that IBM are actually offering SugarCRM, SAP and Microsoft Dynamics CRM. Fine, but how on earth does this make IBM a CRM Vendor? This completely skews the analysis.

The above is only what I have seen in the summary report, I do not intend to buy the full report, based on the above, I would see little value from my perspective. What it does do is raise a question mark over the approach and perspective of these sorts of reports, which for me taints the validity of the whole world of analyst reports. Shame…